Enrich Your Future 12: When Confronted With a Loser’s Game Do Not Play

Listen on

Apple | Listen Notes | Spotify | YouTube | Other

Quick take

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 12: Outfoxing the Box.

LEARNING: You don’t have to engage in active investing; instead, accept market returns by investing passively.

“You don’t have to play the game of active investing. You don’t have to try to overcome abysmal odds—odds that make the crap tables at Las Vegas seem appealing. Instead, you can outfox the box and accept market returns by investing passively.”

Larry Swedroe

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. The book is a collection of stories that Larry has developed over 30 years as the head of financial and economic research at Buckingham Wealth Partners to help investors. You can learn more about Larry’s Worst Investment Ever story on Ep645: Beware of Idiosyncratic Risks.

Larry deeply understands the world of academic research and investing, especially risk. Today, Andrew and Larry discuss Chapter 12: Outfoxing the Box.

Chapter 12: Outfoxing the Box

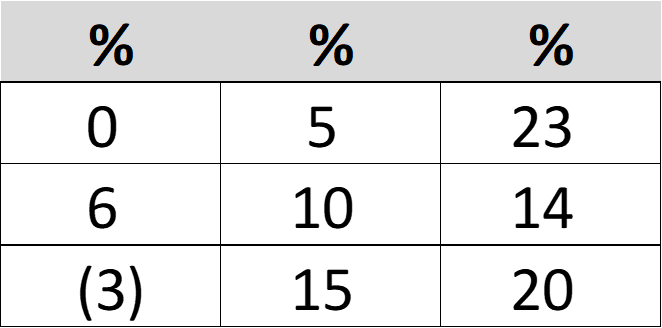

In this chapter, Larry aims to guide investors toward a winning investment strategy: accepting market returns. He uses Bill Schultheis’s “Outfoxing the Box.” This is a simple game that you can choose to either play or not play. The box contains nine percentages, each representing a rate of return your financial assets are guaranteed to earn for the rest of your life.

As an investor, you have the following choice: Accept the 10 percent rate of return in the center box or be asked to leave the room. The boxes will be shuffled around, and you will have to choose a box, not knowing what return each box holds. You quickly calculate that the average return of the other eight boxes is 10 percent.

Thus, if thousands of people played the game and each chose a box, the expected average return would be the same as if they all decided not to play. Of course, some would earn a return of negative 3 percent per annum, while others would earn 23 percent. This is like the world of investing: if you choose an actively managed fund and the market returns 10 percent, you might be lucky and earn as much as 23 percent per annum, or you might be unlucky and lose 3 percent per annum. A rational risk-averse investor should logically decide to “outfox the box” and accept the average (market) return of 10 percent.

In all the years Larry has been an investment advisor, whenever he presents this game to an investor, not once has an investor chosen to play. Everyone decides to accept par or 10 percent. While they might be willing to spend a dollar on a lottery ticket, they become more prudent in their choice when it comes to investing their life’s savings.

Active investing is a loser’s game

Active investing is a game with low odds of success that many would consider a losing battle. It’s a game that, when compared to the ‘outfoxing the box’ game, seems like a futile endeavor. Larry’s advice is to avoid this game altogether.

In the “outfoxing the box” game, the average return of all choices was the same 10 percent as the 10 percent that would have been earned by choosing not to play. And 50 percent of those choosing to play would be expected to earn an above-average return and 50 percent a below-average return.

In his book The Incredible Shrinking Alpha, Larry shows that the odds are far worse than 50 percent. Today, only about 2 percent of actively managed funds generate statistically significant alphas on a pretax basis. If you would choose not to play a game when you have a 50 percent chance of success, what logic is there in choosing to play a game where the most sophisticated investors have a much higher failure rate? Yet, that is precisely the choice those playing the game of active management are making.

Larry adds that research has shown that even the big institutional investors, with all their resources, fail to outperform appropriate risk-adjusted benchmarks such as the S&P 500. In addition to their other advantages, institutional investors have one other significant advantage over individual investors—their returns are not taxable. However, if your equity investments are in a taxable account, the returns you earn are subject to taxes. The incremental tax cost of active funds further reduces your odds of success.

You don’t have to play the game of active investing

Larry’s advice to investors is to avoid trying to overcome abysmal odds—odds that make the crap tables at Las Vegas seem appealing. Instead, he suggests outfoxing the box and accepting market returns by investing passively. Larry quotes Charles Ellis, author of Investment Policy: How to Win the Loser’s Game:

“In investment management, the real opportunity to achieve superior results is not in scrambling to outperform the market, but in establishing and adhering to appropriate investment policies over the long term—policies that position the portfolio to benefit from riding with the main long-term forces in the market.”

Further reading

- Robert D. Arnott, Andrew L. Berkin, and Jia Ye, “How Well Have Taxable Investors Been Served in the 1980s and 1990s?” Journal of Portfolio Management (Summer 2000).

- Charles Ellis, Investment Policy: How to Win the Loser’s Game (Irwin, 1993) p. 24.

Did you miss out on the previous chapters? Check them out:

Part I: How Markets Work: How Security Prices are Determined and Why It’s So Difficult to Outperform

- Enrich Your Future 01: The Determinants of the Risk and Return of Stocks and Bonds

- Enrich Your Future 02: How Markets Set Prices

- Enrich Your Future 03: Persistence of Performance: Athletes Versus Investment Managers

- Enrich Your Future 04: Why Is Persistent Outperformance So Hard to Find?

- Enrich Your Future 05: Great Companies Do Not Make High-Return Investments

- Enrich Your Future 06: Market Efficiency and the Case of Pete Rose

- Enrich Your Future 07: The Value of Security Analysis

- Enrich Your Future 08: High Economic Growth Doesn’t Always Mean High Stock Market Return

- Enrich Your Future 09: The Fed Model and the Money Illusion

Part II: Strategic Portfolio Decisions

- Enrich Your Future 10: You Won’t Beat the Market Even the Best Funds Don’t

- Enrich Your Future 11: Long-Term Outperformance Is Not Always Evidence of Skill

About Larry Swedroe

Larry Swedroe was head of financial and economic research at Buckingham Wealth Partners. Since joining the firm in 1996, Larry has spent his time, talent, and energy educating investors on the benefits of evidence-based investing with an enthusiasm few can match.

Larry was among the first authors to publish a book that explained the science of investing in layman’s terms, “The Only Guide to a Winning Investment Strategy You’ll Ever Need.” He has authored or co-authored 18 books.

Larry’s dedication to helping others has made him a sought-after national speaker. He has made appearances on national television on various outlets.

Larry is a prolific writer, regularly contributing to multiple outlets, including AlphaArchitect, Advisor Perspectives, and Wealth Management.

Larry Swedroe 00:00

We're going to start off. Joe Biden,

Andrew Stotz 00:04

fellow risk takers, this is your worst podcast host, Andrew Stotz from a Stotz Academy, continuing my discussion with Larry swedro, who for three decades was the head of Research at Buckingham wealth partners. You can learn more about his story at episode 645, Larry's unique because he understands the academic research world as well as the practical world of investing. Today we're discussing Chapter 12 in his recent book, enrich your future, the keys of success to successful investing. And the chapter title is out foxing the box, Larry. Take it away.

Larry Swedroe 00:37

Yeah, this is actually one of my favorite stories about helping people find the right way to invest in terms of active versus passive investing. So it was a good friend of mine named Bill Schultheis, who's the author of the coffee house investor, and he wrote a book by that name. He devised this game, which he called out Fox in the box. And in the game, you're presented with these possible outcomes. There are nine, with the one in the center being 10% and each of those boxes represent a potential return of your portfolio. Okay? So there are nine different outcomes.

Andrew Stotz 01:30

So for the for the listener out there, the lowest outcome is minus three and the highest is 23%

Larry Swedroe 01:37

right? So that means, if you were purely random event and you're choosing, you don't know which box you would end up, because you're they're covered up and shuffled around. If you chose a box, you might lose 3% a year for the rest of your life, or you might get lucky and make 23% a year. Now this is a good example in thinking about active investing, because if you're invest as an indexer, and you invest in a total market fund, and the market, let's say, gets 10% which is very close to the long term compound return, you don't have to play the game. You just said, I'm going to invest in equities and I'm going to get 10% obviously you don't know that ahead of time, but if we estimated returns for the total market, we might say that the expected return going forward was 10% so Andrew, you're now giving this a choice of you have the opportunity to say, I do not want to gamble, I do not want to play the market, I do not want to hire active managers. I'm just going to buy a Vanguard Total Stock market index fund, and I'm going to pay something like three basis points for that, and I will get the market return. And let's assume that that's, in this case, 10% or I could suggest you leave the room. We remove the box in the middle, and now it's like a wheel with eight numbers on it, and we're going to spin the wheel, and then you will get in your portfolio the return of whatever number it lands on. So you might get lucky at 23% a year for the rest of your life, or you might lose 3% a year, sort of like active investing because there's no way to know. There's no evidence that anyone has come up with yet to identify which active managers are going to outperform. So Andrew, being a rational human being, should you choose to play the game and blindly accept now the odds are, if 1000 people play the game, because the average is 10% you know, the collective group is going to get 10% on average, but some are going to be in that left tail and dramatically underperform, and some will be in the right tail and dramatically outperform. Now, if you knew 10% was a good enough number to meet your goals, which for most people, it certainly should be, what do you do? Do you play the game, or do you say, I don't want to gamble, I'm going to take the market return? Yeah,

Andrew Stotz 04:37

and it's a good first of all, before I answer that question, it's a good example of the difference between an average and an actual outcome. As an investor, you know, I can look all day and say the average outcome is such and such, but if you play the game, you could end up with the worst outcome or the best. But to answer your question, the last time I went to Las Vegas, my friend. Gambling. And I stayed in the in the hotel room, and then I went walking around town. So I'm not a big gambler. In fact, the last time I went up to a craps table and I got the dice in my hand and I started to roll them, I yelled, Yahtzee. But anyways. But anyways. So being a rational person and understanding the principles here, I just take 10% because 10% is a pretty darn good return over the next, you know, for the rest of my life. Yeah.

Larry Swedroe 05:26

Now we don't know what the market's going to get right. The market may only give us 5% a year right, but then we know the same rules are going to apply, because the average octave fund must get 5% right? Because for every outperformer, there has to be an underperformer, because all stocks have to be owned by somebody, right? So you'll end up with the same thing. You'll have an average number of 5% some might get 15, and someone might lose 10% a year, right? So, but so you're going to choose to play 10, to not play the game. Get the market return of 10. Now this is an unfair example. It actually favors active investing, and you chose not to play it. Why does it favor active investing, because the average active fund does not get the market return. It gets significantly lower returns because of the expenses are higher than an index fund and its trading costs are higher, and the average active fund underperforms by something like, let's call it 80 basis points or so a year. Now that's even, really even worse than that. If you're a taxable investor, because of the taxes imposed by the trading costs and turnover there, means that the odds get even worse. So this is a good example to show why you shouldn't play the game unless you had some advantage and could somehow figure out, how do you identify the few funds that are going to outperform and we know the research shows that only about 2% of them are likely to outperform in any statistically significant way, even before taxes, and that means about 1% for taxable investors. So that's a game I don't think I want to play. So that's the moral of the story. The when it comes to gambling, the surest way to win is to not play.

Andrew Stotz 07:44

Okay? So obviously, everybody out there doesn't play, right? Well, in fact, they don't follow that at all. Everybody's out there hoping that they win. So maybe you can provide some guidance as to when I'm confronted with this, or when the listener or viewers confronted with this and they go back to try to remember this, what is the behavioral bias, or the issue that's causing them to constantly want to go back and play rather than picking the 10?

Larry Swedroe 08:13

Well, let's say it this way, the first thing I would say is that people are learning. I like to think I deserve a little bit of credit with all of my books to help people discover that this is the winning strategy. But certainly people like John Bogle and William Bernstein, Rick ferry and a lot of others have contributed as well. When I started out 30 years ago in this business, only about a few percent of the market was indexed or in other systematic strategies. Today, that number, I've seen estimates as high as 50% so not everyone is choosing to play the game. That's number one. Why do people play the game despite the evidence. One Wall Street doesn't want them to know, as we discussed, because active management is the winning strategy for them. The media doesn't want you to know active management or losing game, because they need you to tune in to figure out what's going on and try to outperform so they can spider and you don't see people like me, or used to be John Bogle very often on TV, you see the active managers who are telling you what's going to happen. So that's a problem. And the third is this, one of the most common human traits is simply overconfidence, as we discuss. If you ask people, are you better than average driver or anything like that, 80 to 90% of the people, regardless of the question, say they're better than average and even investors who have in the. Studies brokerage fund returns, who underperformed said Not that they were a better than average investor, and it outperformed, even though they had underperformed by as much as 10% a year. They still believe they're delusional, but the fact that matters were simply overconfident, so average, but I'm smarter than average, and therefore I can outperform. Being smarter than average does not help you outperform the market. As the evidence from the Mensa Investment Club, which we have discussed, they underperformed the market for over a decade. It was like 15 years by a huge amount, because the competition is just too tough. The intellectual talent at the hedge funds and these institutional investors and high frequency traders, and their collective wisdom and the efficiency of the market makes it just too much to over. So if you put a high value on the entertainment value of trying to beat the market, nothing wrong. Take one or 2% of your portfolio, pick a few stocks, you're probably going to get average returns. But with a wide dispersion of outcomes, some of the people who are doing the same thing, will dramatically underperform. Some will outperform, and we know the people who outperform will attribute it to skill, and the people who underperform will attribute it to What bad luck. When both cases, it's more likely to be just a random outcome. So we people go to the racetrack in Las Vegas. They have an entertainment account, but they don't take their IRA there, and they shouldn't take it to the Merrill Lynch office either. I'm trying

Andrew Stotz 11:49

to think of a visualization. And I remember when I first started as an analyst in 1993 in Thailand, every single broker had everybody came to the broker to trade. You know, nobody called. You know, occasionally, okay, they were calling, but generally, they're coming to the broker to trade, and they would sit grandma and grandpa, in some cases, would sit there. They'd have their pack lunches, and they'd be there all day and watching the ticker tape, watching the tickers. And my

Larry Swedroe 12:18

dad used to take me into the Merrill Lynch office in our neighborhood, and we sit there for a couple hours and watch the tape, yeah.

Andrew Stotz 12:26

And so that's what got me interested in stocks, yeah. And, and what, what, wait, what they did at that time in time then was by that time it had gone digital, where it was just, you know, flashing lights. And so there's this board of flashing red and green lights. And you just walk in there, you think, this is just over stimulating and but, but what I what I the way, the visualization I always used in those days was that I said, you know, many people in this room, because they're also kind of harassing each other and saying, Ah, I'm one today, and, you know, and so they're having fun in that room. And I said that many of those people in the room think that they're competing against each other, but what they don't realize is behind that flickering light is a million people who, in some way or another, is looking at that Thai stock in some way or another, whether it's a passive or an active or whatever, And it's there if they're not playing tennis against a not one other player, or they're not flipping stocks back and forth. They're playing that person against a million. And I'm trying to think about a great visualization to help people understand when you're trading in the market, you're trading against, as you've said, the collective wisdom of all of the competitors. Do you have any good way? Way of I'm thinking like the point of a spear. I'm trying to think of some good ideas. One

Larry Swedroe 13:47

story that comes to my mind is a famous one created by a statistician. You notice that county fairs, they would have this jar of like, jelly beans, right? And they would have to guess. And, you know, you put $1 and you know, guess how many jelly beans were in there, and the person who got closest would win, you know, all of the money, right. And the statistician conducted a study of this, and he found the average scores were way off. But when you average, you know, individually, they were way off. Let's just say there were 872 jelly beans. Maybe no one was even close, but the average score was something like 873 jelly beans. Somehow, the collective wisdom of the market gets it right, and that's maybe a good example. And teachers have been doing this experiment in their classrooms of all kinds of things just like that. And every time they do it, they find, boy, it's amazing. The numbers seem to work, that they actually. Average gas is better than any one individual guest typically. Yeah, that's great.

Andrew Stotz 15:05

That's a great way to think about it, you know, and the collective wisdom so well. On that note, we're going to wrap this one up. Larry, I want to thank you again for another great discussion, and I'm looking forward to the next chapter, which is entitled, between a rock and a hard place. For listeners out there who want to keep up with all that Larry's doing, just find him on Twitter, at Larry swedro, and also on LinkedIn. This is your worst podcast host, Andrew Stotz, saying, I'll see you on the upside. You.

Connect with Larry Swedroe

Andrew’s books

- How to Start Building Your Wealth Investing in the Stock Market

- My Worst Investment Ever

- 9 Valuation Mistakes and How to Avoid Them

- Transform Your Business with Dr.Deming’s 14 Points

Andrew’s online programs

- Valuation Master Class

- The Become a Better Investor Community

- How to Start Building Your Wealth Investing in the Stock Market

- Finance Made Ridiculously Simple

- FVMR Investing: Quantamental Investing Across the World

- Become a Great Presenter and Increase Your Influence

- Transform Your Business with Dr. Deming’s 14 Points

- Achieve Your Goals